Appendix G

SUMMARY OF BRIEFING ON VIET CONG TAXATION

The following is a summary of the briefing on Viet Cong taxation presented on 8 May 1967 by J-2, Military Assistance Command, and based on a Combined Intelligence Center study completed on 1 April 1967:

This briefing is a precis of a recently updated Combined Intelligence Center study on Viet Cong taxation which was based on an analysis of interrogation reports, captured documents, agent reports, and U.S. and South Vietnamese Army files. The Viet Cong rely heavily upon the food and money which they obtain from the economy of South Vietnam. They obtain the majority of this food and money by levying taxes on the populace of the country. This briefing summarizes the various types of taxes levied by the Viet Cong and the major features of their tax system.

Several reasons apparently prompted the Viet Cong to adopt a formalized tax system. First, as the war expanded, food and money were needed in larger amounts and on a predictable basis that would allow the Viet Cong to budget for future operations. Second, a compulsory tax system had the advantage of providing them more direct control over the civilian population. Third, the Viet Cong hoped that a tax would appear to be a more legitimate technique of obtaining funds than the previously used contribution schemes, since the levying of taxes is a governmental function. Fourth, the Viet Cong realized that they needed a way to insure that revenues were not diverted into the collector's pocket. Finally, they have for many years maintained detailed census statistics covering most of South Vietnam; these statistics would facilitate the establishment of a tax system.

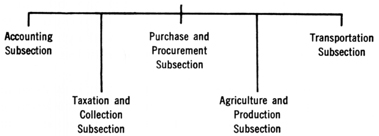

The tax system is directed at the national level by trained economic advisers, who comprise the finance and economic section of the Central Office of South Vietnam. At province, district, and village level, the actual operation of the tax system is carried out by the taxation and collection subsection of the echelon finance and economic section. In addition, a typical echelon finance and economic section contains several other subsections.

There has been a marked upward trend in Viet Cong tax rates as their requirements for food and revenue have grown. In addition to raising rates, the Viet Cong have attempted to increase tax revenues by enlarging the areas covered by taxes and by initiating

[166]

Appendix G-1 - FINANCE AND ECONOMIC SECTION

new taxes in areas already under taxation. Viet Cong revenues in 1965, of which tax collections were the chief component, were estimated at two billion piasters.

Various types of taxes are important to the enemy. At the present the Viet Cong are levying taxes on agricultural production, transportation, plantations, businesses, imports and exports, property, and income in descending order of importance. The majority of food and money derived from the tax system comes from agriculture, transportation, and marketing of agricultural products.

The rice tax, the most important of the agriculture taxes, provides the Viet Cong with their largest amounts of food and money. In fact, a directive from the Central Office of South Vietnam states that 80-90 percent of the annual Viet Cong budget is obtained through this type of taxation. Agricultural tax rates vary in different parts of the country, but on an average the Viet Cong tax 25-30 percent of the farmer's crop. In some areas, however, they have collected all of a farmer's paddy at harvest except for the amount required by his family for subsistence.

The second most important tax to the Viet Cong is the transportation tax. This tax has several advantages to the insurgents. First, it can be collected on a hit and run basis at collection points which are located on major lines of communication in areas which favor control of the road or waterway and which offer ready escape if the point is discovered. Also, since the taxes are levied on transients, the Viet Cong do not incur the discontent of a particular locale. Second, the rates can be raised quickly in order to meet current operational needs. Third, the transportation tax allows the Viet Cong to maintain a degree of control over many of the ICUs in South Vietnam. At the present time the Viet Cong are taxing literally everything that moves through their own and government-controlled areas.

Until 1966, Viet Cong taxes on plantations in South Vietnam may have been second in importance only to agricultural taxes.

[167]

These taxes have accounted for as much as half of the total Viet Cong revenues in a few provinces where there are concentrations of plantations. However, operational difficulties and the resistance of some owners to Viet Cong taxation are possibly reducing this source of funds and forcing the enemy to depend less on this form of taxation.

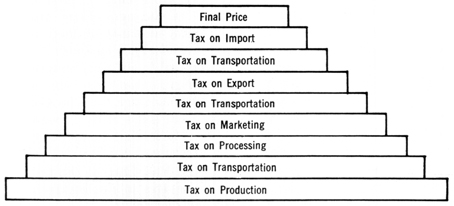

The tax system has two strong points. First, it is designed to draw revenue from every segment of the South Vietnamese economy. Second, the system allows for the pyramiding of taxes; that is, multiple revenues can be gained by directly or indirectly taxing a single item on each of the normal stages of production, transportation, processing, and marketing. Frequently export, import, and additional transportation taxes will be levied on an item as it passes through Viet Cong-controlled areas in route to final consumption. All of these taxes are added in arriving at the final price of the item.

Appendix G-2 - IMPACT OF VIET CONG TAXES

The system does contain inherent weaknesses. First, it requires that the collector and administrator be well trained if it is to work effectively. Such persons are currently in short supply for the Viet Cong. Second, increasingly heavy taxes are being levied on the populace. Discontent on the part of the people is only natural under such circumstances. Third, allied operations in an area often prevent the Viet Cong from collecting taxes.

Despite these weaknesses, the Viet Cong tax system is highly effective and supplies the enemy with substantial amounts of food, money, and control over the population.

[168]

page created 8 January 2003